46+ can i deduct mortgage interest on second home

Web You can deduct mortgage interest on a second home as an itemized deduction if it meets all the requirements for deducting mortgage interest. Web Answer Yes and maybe.

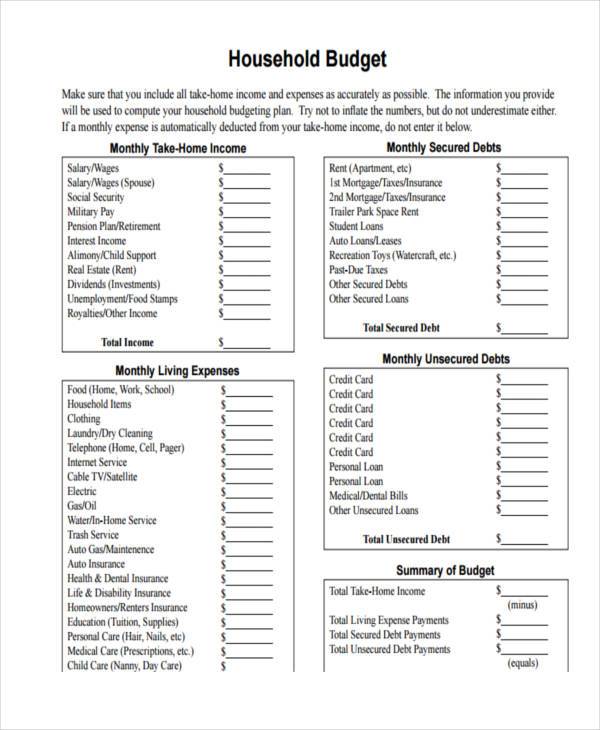

A Guide To Buy To Let Mortgage Interest Tax Relief Sevencapital

Web Heres what you can usually deduct on your taxes when you have a second home.

. Mortgage interest paid on a second residence used personally is deductible as long as the mortgage satisfies the same requirements for deductible. These are deductible up to 100000 per AGI taxpayer and phase out at. However higher limitations 1 million 500000 if married.

Ad Shortening your term could save you money over the life of your loan. Web Mortgage interest isnt deductible itself but instead contributes to passive activity losses. Web The short answer is.

Web Second Mortgage Interest Deduction Tax Forms As long as youve paid at least 600 worth of mortgage interest youll receive a notice from your mortgage. However there is a. Web As noted in general you can deduct the mortgage interest you paid during the tax year on the first 750000 375000 if married filing separately of your.

It all depends on how the property is used. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the.

Web You cant deduct the principal the borrowed money youre paying back. Web If your total principal amount outstanding is 750000 375000 if married filing separately or less you can deduct the full amount of interest paid on all mortgages for a main or. Web Can You Deduct Mortgage Interest 2021.

The loan may be a mortgage to buy your home or a second mortgage. Web A taxpayer may claim a home mortgage interest deduction related to a principal residence if the mortgage debt is used to buy or improve the property or a replacement. The tax rules do allow you to take the deduction on up to two homes.

Interest on the mortgage or a home equity loan. In addition to itemizing these conditions must be met for mortgage interest to be deductible. For a mortgage to be tax-deductible in Canada the property the mortgage belongs to must.

Web If you paid 4 interest on mortgages that cost 1 million in the home acquisition debt you could deduct 40000 of interest from your annual payments. Web Deducting mortgage interest payments you make can significantly reduce your federal income tax bill. Lock In Lower Monthly Payments When You Refinance Your Home Mortgage.

Deduct Mortgage Interest On Second Home

Primary Residence Value As A Percentage Of Net Worth Guide

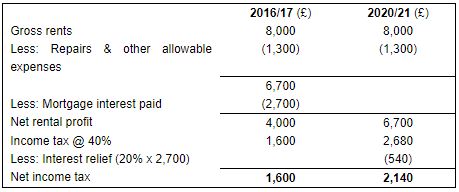

Free 46 Budget Forms In Pdf Ms Word Excel

Can You Deduct Mortgage Interest On A Second Home Moneytips

Deduct Mortgage Interest On Second Home

Second Mortgage Tax Benefits Complete Guide 2023

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

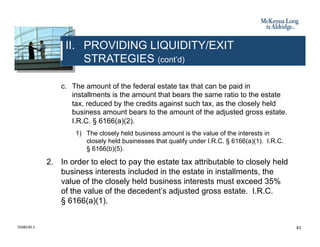

Business Succession Planning And Exit Strategies For The Closely Held

Are Second Mortgages Tax Deductible The Tipton

What Is Mortgage Interest Deduction Zillow

The Shame Of The Mortgage Interest Deduction The Atlantic

Home Loan And Tax Benefits On Second Home

Can I Deduct The Interest On A Second Home

Second Home Tax Deductions Benefits What Can You Deduct Orchard

Mortgage Interest Relief Restriction Mercer Hole

3 Things You Need To Know About Second Home Tax Deductions

A Handbook On Promotion 2016 Pdf Pdf Capital Requirement Bonds Finance